Angel Bridge is committed to hands-on support as an “advocate of entrepreneurs”, fostering the creation of world-renowned mega-ventures

ABOUT US

Our team with extensive experience working at top-class professional firms maximizes the potential of entrepreneurs, so that they are able to bring about an innovation through their ingenious businesses

Fund

The fund’s total assets under management (AUM) is $110 million. We can invest up to $15 million per company, including follow-on investments. Due diligence process is flexible and short (about 1-2 months)Investment Target

Our primary investment targets are startups in the seed to early stages, growth of which is generally accelerated through hands-on support. We aim to invest in startups with the potential to become mega-ventures that can significantly impact the world in the futureHands-On Support

We continue to provide substantial hands-on support even after the investment. Depending on their needs, we help our startups not only through financing, but also in developing their organization and growing their businessesPORTFOLIO

The ambitious entrepreneurs supported by Angel Bridge undertake in innovative and groundbreaking businesses with the potential to create innovations that can significantly impact the world

LIMITED PARTNERS

Angel Bridge has managed a total of ¥15.2 billion in funds. We have major institutional investors as Limited Partners (LP), and provide substantial hands-on support and funds to portfolio companies in order to create startups that will lead Japan's economy.

TEAM

Our team has experience working at top-level professional firms. We provide extensive support to entrepreneurs through sophisticated and speedy execution capabilities, as well as an intricate network that spans various fields

TEAM

Our team has experience working at top-level professional firms. We provide extensive support to entrepreneurs through sophisticated and speedy execution capabilities, as well as an intricate network that spans various fields

HANDS-ON SUPPORT

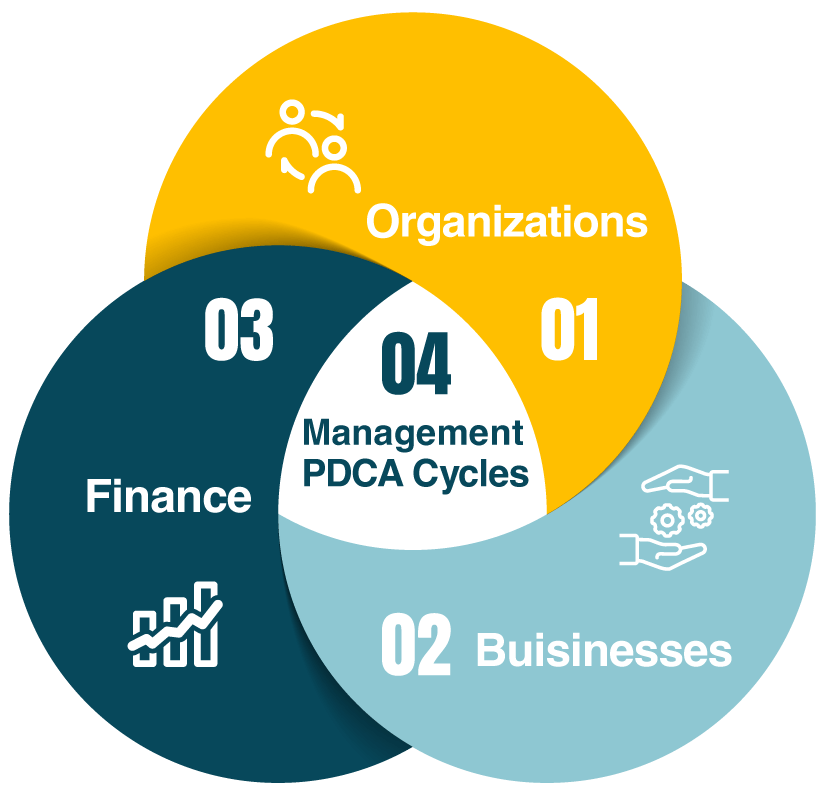

Angel Bridge sees its purpose not only in making investments but also in supporting subsequent growth. Depending on the needs, we provide unwavering dedicated support for Organization (People), Business (Operation), Finance (Capital), and in creating a PDCA cycle for Management